UPI and card payments have gained immense popularity in recent years.

But cheques remain a widely used and accepted form of payment in India.

In fact, even TV and movie actors got paid through cheques.

If you are writing a cheque for the first time, it can be an overwhelming experience.

I am here to make it a simpler and smooth process.

Today I am going to share how to fill in cheque in India.

After reading this post, you will be able to write cheques confidently and safely

Without further ado, Let’s just dive in.

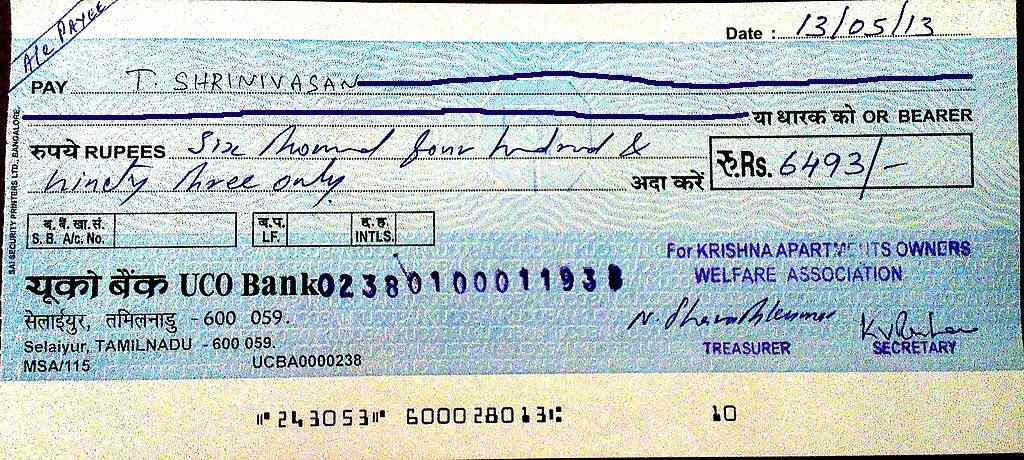

Image Source: wikimedia.org

Table of Contents

What is a Cheque

A cheque is a document that instructs your bank to transfer a specified amount to a person or organization

Cheques are used to make payments for goods and services, to pay bills, and to transfer money between accounts.

Drawer: A drawer is a person who writes the cheque.

Drawee: A drawee is an institution that is ordered to pay a certain sum of money to the payee when a check or draft is presented. Typically a drawee is a bank, but it can also be a credit union, a financial institution, or even a retail store.

Payee: A payee is the person who receives the money.

Types Of Cheques

There are different kinds of cheques.

Bearer Cheque: A bearer cheque is a type of cheque that can be encashed by anyone who has it. The cheque does not have the name of the payee written on it, so it can be passed on to anyone.

Order Cheque: An order cheque is a type of cheque that can only be encashed by the person named on the cheque. The name of the payee must be written on the cheque. And the payee has to sign the back of the cheque in order to encash it.

Crossed Cheque: Crossed cheque is a type of cheque that can only be deposited into a bank account. This type of cheque has two parallel lines drawn on the top left corner of the cheque. You should write “a/c payee” between the lines.

These cheques are safer because they can be deposited only in the payee’s bank account.

Open Cheque: This kind of cheque is uncrossed. It does not have two parallel lines drawn across it.

It can be encashed at any bank. An open cheque is transferable by the payee, allowing them to change the recipient of the payment.

Self Cheque: A self-cheque is when the issuer writes “self” as the payee. It allows the issuer to withdraw money from their own bank account.

There are some other kinds of cheques as well.

If you want to know more about the type of cheques, IDFC shared a detailed guide on it.

Essential Points To Keep In Mind When Writing Cheques

Writing a cheque may seem intimidating if you haven’t done it before. However, by keeping a few essential points in mind, you can ensure a smooth and accurate process.

Here are the key points to remember when writing a cheque:

Write The Date

Write the date carefully in this format DD/MM/YYYY. Don’t leave any space while writing the date.

The cheque will be valid for 3 months from the date you write.

Don’t Overwrite

Never overwrite anything on the cheque. If you do overwrite, it will be rejected.

Make sure you check the spelling carefully.

If you think you have done a wrong signature, do it again. But don’t overwrite on the previous signature.

Don’t Leave Spaces Between Words

You should never leave spaces between words.

Let me explain to you why.

Suppose you are writing 10000 .

People can make it 100000.

So don’t leave any spaces. And after writing the amount write this /-.

It will ensure that no one can write anything after that.

Similarly don’t leave space while writing the amount in numbers.

If you are Twenty-Five Thousand.

Someone can make it 1 Lakh Twenty-Five Thousand.

Better you don’t leave any spaces.

And when you write the numbers in words, make sure to write “only” after the amount.

For example Fifty Thousand Only.

Write The Payee’s Name Carefully

Needless to say, write the payee’s name carefully.

Let’s say, You are issuing a cheque to Sumit Sharma.

It can be Sumita Sharma. Just leave a small space between your name and surname.

The same can happen with the surname. So after writing the surname draw a line.

You can see the line in the above image.

Issue Crossed Cheques As Often As You Can

You should issue crossed cheques as frequently as you can. It is safe to issue crossed cheques.

Wondering how to write a crossed cheque.

Just write two parallel lines drawn on the top left corner of the cheque and write “a/c payee” between the lines.

Once you write a/c payee, the amount can’t be withdrawn.

It can be deposited in the payee’s bank account only.

Avoid Beaer Cheques

Bearer cheques allow anyone to encash the cheque. There’s always a risk to use it.

You should avoid using it.

You need to just draw a line over the “Or Bearer” text to avoid bearer cheques.

Keep Your Signature Consistent

Your signature should match the bank record. It should be the same all the time.

MICR Code Is Important

Some people staple cheques on the MICR code. It’s a terrible mistake.

It is important to handle cheques with care to avoid tampering with the MICR (Magnetic Ink Character Recognition) code.

MICR code helps the bank to validate the cheque.

Keep Record Of Your Cheques:

Each cheque book contains a slip.

Write your every cheque transaction details to keep records of your transactions.

Check also –

- Canara Bank ATM Pin Generate By Mobile

- State Bank Of India Online Bank Statement

- What Is Customer Id In Canara Bank

- CIF Number For Indian Bank

How To Fill In Cheque In India

Now let’s see how to fill in cheque in India.

- First of all, write the name of the payee. Don’t leave any spaces. Draw a line.

- Enter the amount in numbers. And write /- after the amount.

- Now write the amount in words and write “only” after the amount.

- If you don’t allow the payee the withdraw the money, just draw two parallel line and wrote a/c payee.

- Sign the cheque.

- Enter the date in DDMMYY format.

- If you want only the payee should collect the cheque, you can strike off “Or Bearer”.

- That’s it.

How To Write A Cancelled Cheque

Now for many purposes, we need a cancelled cheque.

Here are some possible reasons why you might need a cancelled cheque.

- EMI

- Invest in Mutual Fund

- Buy Insurance

- Demat Account

- ECS

And so on.

Now let’s see how to write a cancelled cheque.

- First of all, take a blank cheque and draw two parallel lines on the cheque.

- Now write “Cancelled” between the lines.

- You don’t need to fill in any information.

- And do not sign the cheque.

Conclusion

I have shared a guide on how to fill in cheque in India. I hope now you can write a cheque yourself.

By following the step-by-step process outlined in this blog post, you can write a cheque.